Medical check-ups and health related expenses.

CONTRACTOR EXPENSES PROFESSIONAL

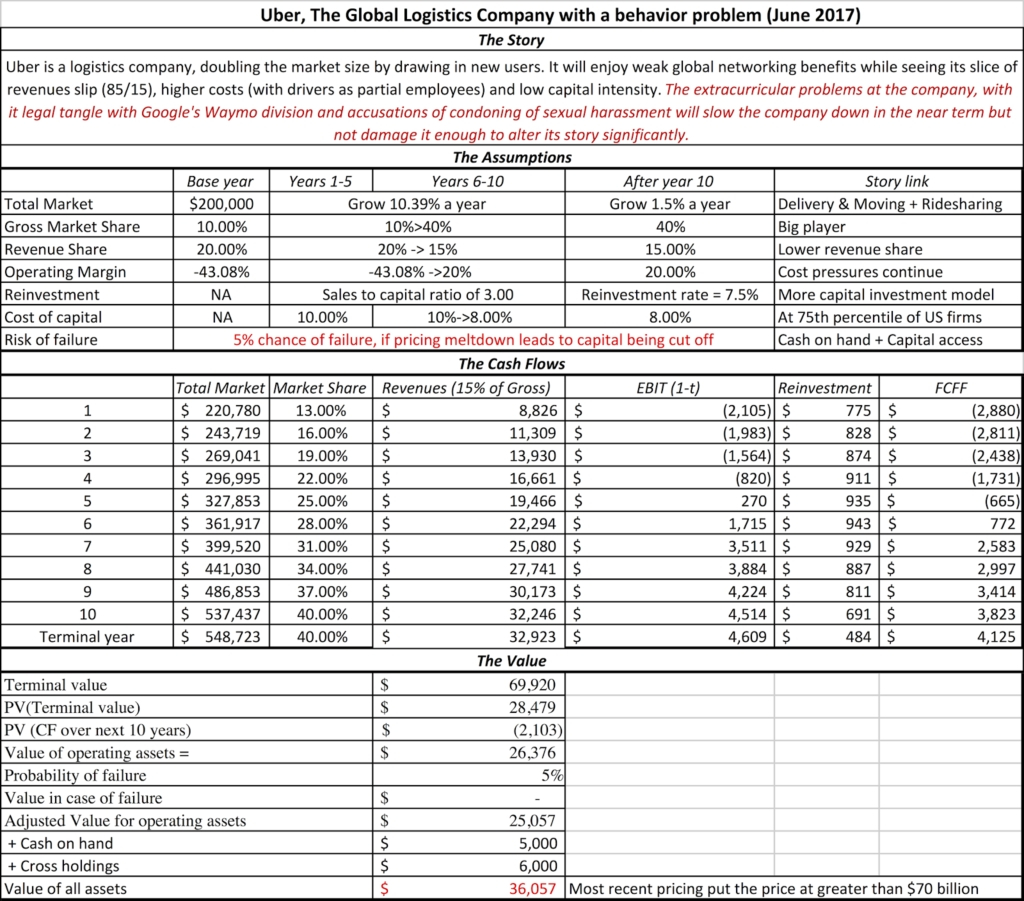

Legal, accounting, and other professional fees.Subscriptions to professional organisations.Stationery, business cards, postage, printing, etc.Salaries, wages, commission, and benefits.Most commonly incurred contractor company expenses Most expenses can be offset against the income of the company except few such as client entertainment.You must keep original receipts and relevant documents in relation to expenses incurred.You can only claim an expense that have been incurred ‘wholly and exclusively’ for the purposes of your business.There are some basic principles which you should keep in your mind when claiming any expense as for business purposes. This is really important when it comes to enforcing payment deadlines and penalties. Usually at the top, beside the invoice number. The above format shows that higher the figure of allowable expenses will result in lower taxable profits and ultimately lower corporation tax payable. If you ever need to discuss a specific invoice, unique invoice numbers make it much easier for both the contractor and their client. Your company will pay corporation tax on taxable profits at the current rate of corporation tax which is 19%. Turnover (Total of all invoices excluding VAT) XXX Please find below a summary format showing how the corporation tax is calculated: A contractor expense claim form is used by construction companies to report information about contractor expenses that have been incurred. Breaches of policy are serious and could even be fraudulent so it’s important that any contractors and consultants are made aware of travel and expenses policies before incurring any unexpected costs to. It is therefore worth taking time to understand what you can and cannot be claimed as expense. Contractors and consultants should be expected to act with honesty and integrity when they follow any company’s expenses policy. Claiming all your allowable business expenses could reduce your corporation tax bill. In accounting, an expense is an outflow of cash or other asset of value incurred during a particular accounting period.Īs a limited company contractor, you may incur various business expenses whilst undertaking your contract duties. In simple terms, expense is the money spent by an organisation for the purpose of business.

0 kommentar(er)

0 kommentar(er)